- Details

- Written by: admin

- Category: Idea CAD EN

- Hits: 375

Air transport is the fastest-growing issue of anthropogenic CO2. One Boeing 747 can emit as much CO2 as 240 cars in a year. Presently, technologies of free-emission planes are at a very early stage of development and are impossible to mass-produce.

This doesn't mean that airlines are unable to participate in the process of decarbonization of the world economy. Idea CAT assumes that emitters that are unable to reduce emissions in their industry will be allowed to invest money from CAT in emission-free sources of energy in another branch of the economy.

Airlines will be buying fuel taxed by CAT. When the fuel is used, airlines will be allowed to receive from the budget the CAT subsidies. These subsidies can be used for many purposes. For example, to build a wind power station

- Details

- Written by: admin

- Category: Idea CAD EN

- Hits: 344

Mr. Smith is the owner of a gasoline taxi car. In this case collection of the tax takes place when a tanker with oil arrives at the port. Then the crude oil will go to the refinery, where it will be processed into gasoline. Before the gasoline reaches the gas station, it will pass through the hands of many brokers. Every one of them will issue an invoice where the CAT will be counted. In the end, Mr. Smith poured gasoline into the tank, and now, as the final recipient, he is entitled to a CAT tax refund. As taxable fuel is expensive so Mr. Johnes is thinking of buying a hybrid car. Normally, such a car is more expensive to buy than a car with a classic drive, but the situation will change after entering the CAT introduction. When Mr. Johnes buys a hybrid car, he will be entitled to a CAT tax refund each time he refuels. When the total value of returned tax equals the value of the batteries and electric engine, Mr. Jones will be allowed to use the CAT subvention for other purposes. In this way, everybody will take advantage of it.

Mr. Smith is the owner of a gasoline taxi car. In this case collection of the tax takes place when a tanker with oil arrives at the port. Then the crude oil will go to the refinery, where it will be processed into gasoline. Before the gasoline reaches the gas station, it will pass through the hands of many brokers. Every one of them will issue an invoice where the CAT will be counted. In the end, Mr. Smith poured gasoline into the tank, and now, as the final recipient, he is entitled to a CAT tax refund. As taxable fuel is expensive so Mr. Johnes is thinking of buying a hybrid car. Normally, such a car is more expensive to buy than a car with a classic drive, but the situation will change after entering the CAT introduction. When Mr. Johnes buys a hybrid car, he will be entitled to a CAT tax refund each time he refuels. When the total value of returned tax equals the value of the batteries and electric engine, Mr. Jones will be allowed to use the CAT subvention for other purposes. In this way, everybody will take advantage of it.

1.) Mr. Johnes has a new hybrid car, which will be cheaper in exploitation.

2.) The environment gains because of a new car; Mr. Johnes emits less CO2.

- Details

- Written by: admin

- Category: Idea CAD EN

- Hits: 408

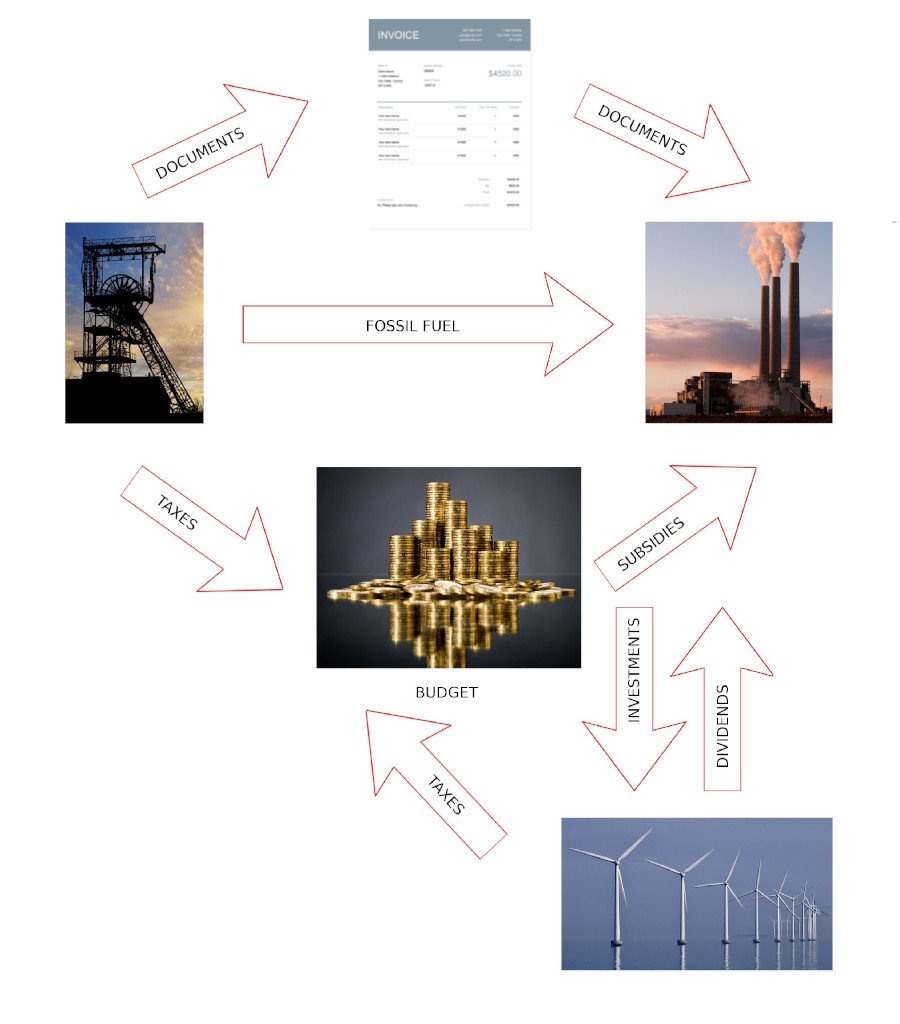

The energy group buys coal from coal mining. Payment tax to the budget occurs at the moment when coal is mined on the surface. The invoice issued by the mine specifies the amount of CAT tax. Of course, this affects the gross price of coal and makes coal uncompetitive as a source of energy. Unfortunately, owners of a coal power station don't have an alternative because they are not able to produce electricity without CO2 emissions. To move away from coal and build a wind power plant, a water power plant, or a nuclear power plant is needed. And here the CAT tax can be helpful. At the moment of the burning of coal, owners of coal power plants settle the paid CAT tax and apply to the Ministry of the Environment for subsidies, with the proviso that the entire amount of the subsidy will be allocated to the emission-free sources of energy. Whether the owners invest their money in a nuclear or solar plant depends on their decision. Let the free market decide.

After building an emission-free power plant energy group has two power plants: first, it uses expensive coal, and a second,d emission-free power plant which uses an energy source that is included in the CAT tax. This means that faster or later coal power plants will be closed and in this way, we will achieve the main goal for the CAT tax, which reduction of CO2 emissions.

Simultaneously, a newly built emission-free power plant is starting to make profits to the energy group. So the money invested goes back to the investor as a dividend.

Now, a little digression. The Polish capital is just beginning. We have only 25 years of experience in this field. Our domestic capital is simply too weak to bear the costs of building a nuclear power plant. Even windmills are built by foreign investors. And then the CAT tax can be useful. State subsidies paid to CO2 emitters will make it possible to decarbonize the whole Polish industry only with Polish capital. Maybe we will be able to finance this way, building our first nuclear plant.

Of course, dividends will be taxed as well as the building of an emission-free power plant, manpower, and so on. In this way, a large part of the subsidy will return to the budget. The society will also benefit in another way. Environmental pollution will be reduced a new place of work will be created.

- Details

- Written by: admin

- Category: Idea CAD EN

- Hits: 1262

{youtube}https://www.youtube.com/watch?v=xUezO4ahMNY{/youtube}

I aim to present my short thoughts on the economic solution of CO2 emissions reduction. If we agree that climate change is a result of human activity and decide to take action for emissions reductions, we must know that carbon credit is not the only option. In the opinion of many well-known economists, the carbon tax is an effective alternative to carbon credits, which is a complicated mechanism and, for this reason, ineffective. The idea of carbon credit required the strict control of every chimney by thousands of civil servants. Fortunately, there is an alternative to emission trading this alternative is the carbon tax.

The carbon tax already existed in British Columbia, Chile, Iceland, Sweden, Switzerland, the Netherlands, Norwegian, and RSA. In general, the idea comes down to the imposition of tax on every fossil fuel proportionally to CO2 emissions formed during combustion. Its aim is to cover the hidden costs of climate change in the price of fossil fuels.

The carbon tax was considered a good solution by many economists, including Nobel Prize winners Milton Friedman, Arthur Laffer, Greg Mankiw, Jeffrey Sachs, and Alan Greenspan.

One question remains: what to do with the money raised from taxes? Do we have to spend this money on the salaries of civil servants, the reduction of the budget deficit, or maybe on the army or social care? And here I will make my contribution to the idea of the carbon tax. In my opinion, it will probably be best to invest that money in emission-free sources of energy. In other words, for money obtained from the carbon tax, we should build wind, solar, or nuclear power plants, electric or hybrid cars, and everything that can contribute to emissions reduction. In this way, we will be able to reduce the demand for fossil fuels both from the demand side (higher prices of fossil fuels will make fossil fuels uncompetitive ) and from the side of the supply side (newly created emission-free sources of energy will cause the fuel to become unnecessary).

The only question is who will invest taxpayers' money in the wind, solar, or nuclear power plants? Who will buy electric or hybrid cars? The state or private individuals? If we assume that the state will invest taxpayers' money into emission-free sources of energy, it can lead to the creation of a new energy communism with all the consequences. The second question is ethical. Is this OK for the owner of the carbon power plant to build his state, emission-free competition for the tax money that he paid? And on a micro-scale. What to do with a taxi driver who will buy him an electric or hybrid car?  I have a free-market point of view on economics, and in my opinion, emission-free sources of energy should be created in the private sector. And all of this from nuclear power plants to solar panels and electric motorbikes. My idea is that the whole money raised from the carbon tax should be transferred to emitters of CO2 as a targeted subsidy in order to they will have funds for investment in emission-free sources of energy. The next question arises on how to organize it and not to employ a new army of officials, without bureaucracy or complicated regulations. Well, there is a solution to this problem. All that we need to do is the modification of the Value Added Tax, which exists in most countries in the world. How can it work?

I have a free-market point of view on economics, and in my opinion, emission-free sources of energy should be created in the private sector. And all of this from nuclear power plants to solar panels and electric motorbikes. My idea is that the whole money raised from the carbon tax should be transferred to emitters of CO2 as a targeted subsidy in order to they will have funds for investment in emission-free sources of energy. The next question arises on how to organize it and not to employ a new army of officials, without bureaucracy or complicated regulations. Well, there is a solution to this problem. All that we need to do is the modification of the Value Added Tax, which exists in most countries in the world. How can it work?

The first phase is tax collection.

The carbon tax should be collected at the time of extracting fossil fuel from the surface or at the moment of customs clearance of fossil fuel in the case of import from abroad. There is no necessity to employ new functionaries to handle tax collection. Those officials who collect VAT, duty, and excise are enough. It is only necessary to reprogram the computers of the tax and customs office. We do not have to be afraid of abuse. It's hard to hide from the tax office the fact of the extraction of coal heaps by a mining company or the arrival of the tanker at the port. So the problem of tax collection is solved.

Phase two: tax settlement.

Each seller of fossil fuel must be obligated to the settlement of the carbon tax on the invoice. This also shouldn't be difficult. We must only reprogram computers and cash registers. The amount of the tax shouldn't depend on fossil fuels but on CO2 emissions after fuel combustion. Only the first producer or fossil fuel importer will be the taxpayer next seller will only be obligated to settle the tax on the invoice. The carbon tax settlement takes so long because the last buyer will burn the fuel and emit CO2 into the atmosphere.

Phase three: granting subsidies to emitters.

The moment when the emitter burns the fuel, the emitter becomes the last link of the chain. Now the emitter is allowed to apply for a targeted subsidy, which can be used only on investment in the emission-free source of energy. The environmental ministry pays a grant equal to the amount of the carbon tax from invoices for burnt fuel. Then the emitter makes the investments in emission-free sources of energy, simultaneously informing the environmental ministry what exactly subsidies are issued and where exactly are purchased assets. Receiving subsidy emitter is obligated to inform where windmills, solar panels, water plants, or electric cars are. Now the only task of ministry officials is to check if the money was correctly spent. It should not be difficult because this is very easy to check if the power plant has really been built.

Phase four: the return on investment profits.

Investment in emission-free sources of energy, sooner or later, will bring profit to the investor. Of course, the income is taxable, so the benefits are mutual between the state and the investor. Investments in emission-free sources of energy have a positive impact on the economy, so everyone benefits.

Phase five: emissions reduction.

Emission reduction takes place in two ways. Firstly, taxed fuel becomes more expensive and therefore less competitive in the global energy market than emission-free sources of energy, which contributes to the decline in demand for fossil fuels. On the other hand, promoted by the carbon tax, investments in emission-free sources of energy increase the supply of such assets on the energy market. In the condition of application of this tax, emission-free sources of energy have lower gross costs and a significant competitive advantage over those sources of energy that emit CO2. In this way, we reach the goal of the carbon tax, which is a reduction of CO2 emissions. As time passes, CO2 emissions will go down, and the supply of emission-free sources of energy will grow. It can be predicted that investments in emission-free sources of energy will come both from the carbon tax and portfolios of private investors. All this together will lead to a CO2 emission reduction. And that's what it's about.

Author Piotr Bartyś

I suggest calling this tax CAD, as an abbreviation of the words Carbon Added Tax.