- Details

- Written by: admin

- Category: Idea CAD EN

- Hits: 111

Each tax, as well as the method of spending funds obtained from it, is subject to moral assessment. CAT is a consumption tax. Its introduction will affect the price of all goods produced using fossil fuels: cement, steel, cars or tourist trips to Thailand. The factor that drives CO2 emissions is the consumer lifestyle, which manifests itself, for example, in the purchase of a car with increased engine power, even though an economical car performs its functions in the same way. Buy unnecessary, throw away undamaged. The production and maintenance of this mass of goods consume enormous amounts of energy and contribute to climate change like nothing else. So it is deeply ethical that consumers will bear the final costs of reducing emissions because they are both the cause of the problem and they are the solution. The owner of a sports car will pay more tax than the owner of an economical city car, while someone who commutes to work by public transport will pay even less tax. Similarly, someone who goes on vacation to the Masurian Lakes will pay less than someone who rests while surfing in Hawaii. This applies to all forms of consumption. If you invest in home insulation, you'll pay smaller bills for CAT-charged gas or oil.

CAT promotes the reduction of emission-generating consumption and supports actions to reduce emissions while maintaining the current lifestyle.

CAT has one more ethical aspect. Manufacturers and importers of fossil fuels will be the direct taxpayers. It is deeply ethical that those who benefit the most from poisoning our planet with carbon dioxide will be charged a tax that will clean up this mess. The attitude of governments towards fossil fuel producers is ambiguous. On the one hand, they strive to reduce emissions; on the other, they subsidize their mining industry. Charging this industry with a CAT tax will be deeply moral.

One should not worry too much about the condition of this sector. The new tax (like any tax) will be passed on to consumers. Only when emission-free energy sources appear can the profits of this sector begin to fall.

CAT also has a flip side. All money from this tax is to be spent on decarbonizing the economy. They will not go to the state budget, they will not go to social protection, budget deficit reduction or subsidies for fossil fuel producers. All income is to go to decarbonize the economy. This is also moral. The purpose of the tax is to save the climate, and the money accumulated in this way should go exactly for this purpose.

Another issue is how the tax is spent. There is no doubt that the subsidies obtained from the CAT will affect the accounts of CO2 emitters. And it is CO2 emitters that will invest this money in zero-emission energy sources that will bring them profits. So they will be the largest beneficiaries of this tax. The paradox is that it is CO2 emitters who are treated by the emission trading system as the source of the problem in the new system and become its solution. But keep in mind that since the Phoenicians invented money, there is no better way to motivate people to work.

- Details

- Written by: admin

- Category: Idea CAD EN

- Hits: 52

It must be honestly said that just like the minimum wage and social security have some effect on the price of a hamburger, the CAT tax will also affect the gross price of gasoline at the station, natural gas, etc. However, I would like to point out that the main goal of CAT is to reduce global demand for fossil fuels, which should result in a reduction in net fuel prices. This should limit the negative consequences of the introduction of CAT for the economy and our pockets.

It must be honestly said that just like the minimum wage and social security have some effect on the price of a hamburger, the CAT tax will also affect the gross price of gasoline at the station, natural gas, etc. However, I would like to point out that the main goal of CAT is to reduce global demand for fossil fuels, which should result in a reduction in net fuel prices. This should limit the negative consequences of the introduction of CAT for the economy and our pockets.

- Details

- Written by: admin

- Category: Idea CAD EN

- Hits: 86

In recent years, knowledge about the dangers of global warming has been increasing in society. This fact is optimistic, but it should be remembered that in the current legal state, ordinary people have very little opportunity to take real action to reduce CO2 emissions. Real activities are carried out by a very elite group of politicians, environmental activists, CO2 emission brokers, and wind turbine manufacturers. An ordinary person can vote for Hillary Clinton or participate in climate demonstrations.  After the introduction of CAT, the situation will change. Because all CO2 emitters (including car owners) will have the opportunity to take part in real actions to decarbonize our economy. The more real that it is related to real material benefits for the participants. Involvement in the action of many ordinary people will allow a change in the political balance of power in the world, and will allow for taking quick and effective actions to reduce emissions.

After the introduction of CAT, the situation will change. Because all CO2 emitters (including car owners) will have the opportunity to take part in real actions to decarbonize our economy. The more real that it is related to real material benefits for the participants. Involvement in the action of many ordinary people will allow a change in the political balance of power in the world, and will allow for taking quick and effective actions to reduce emissions.

- Details

- Written by: admin

- Category: Idea CAD EN

- Hits: 159

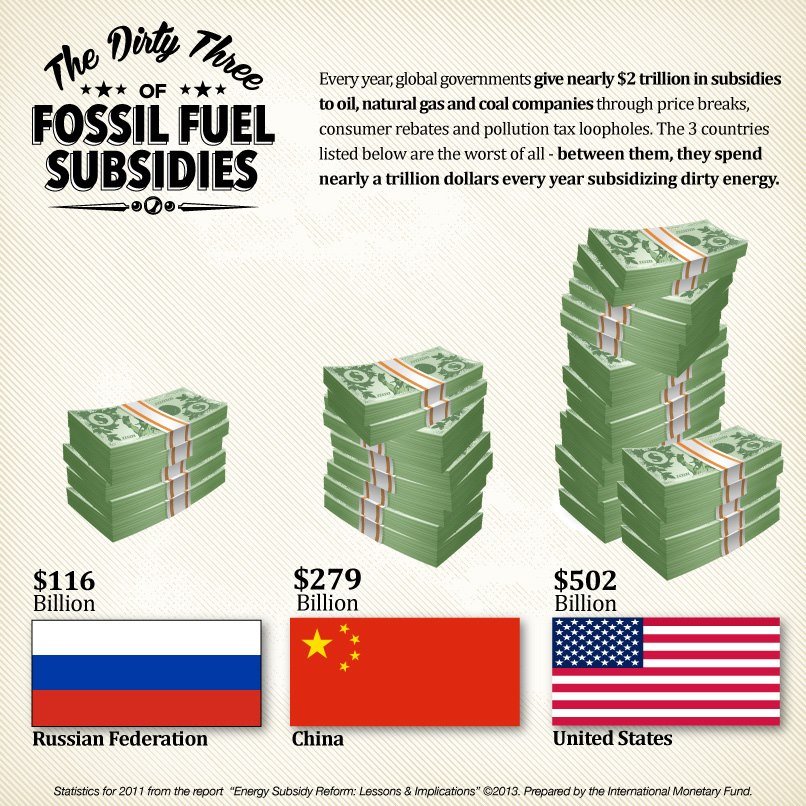

The fight against global warming is not just overt political action, but also a lobbying clash. Fossil fuel producers are actively opposed to emissions reduction. Carbon dioxide emitters are also trying to torpedo emission reduction plans. It is easy to understand that both fossil fuel producers and CO2 emitters have a lot of money to lose. Together, they constitute 100% of our economy. Manufacturers of windmills and solar cells have much more modest resources. Considering these conditions, it is not surprising that although scientists have been warning against global warming for half a century, the effects of remedial actions are more than meager.  President Donald Trump's decision to withdraw the United States from the Kyoto Protocol is a prime example of the strength of the combined forces of fossil fuel producers and CO2 emitters. According to data from 2014, the G20 countries spend $ 88 billion annually to subsidize the extraction of fossil fuels. Much of this business is state-owned. So the money flows the other way. Now, let's consider how the lobbying balance of power will change after the introduction of CAT. Only producers and importers of fossil fuels will be direct CAT taxpayers.

President Donald Trump's decision to withdraw the United States from the Kyoto Protocol is a prime example of the strength of the combined forces of fossil fuel producers and CO2 emitters. According to data from 2014, the G20 countries spend $ 88 billion annually to subsidize the extraction of fossil fuels. Much of this business is state-owned. So the money flows the other way. Now, let's consider how the lobbying balance of power will change after the introduction of CAT. Only producers and importers of fossil fuels will be direct CAT taxpayers. They constitute at most 3% of the world economy. So those who benefit the most from poisoning our planet will have to pay the costs of decarbonizing the economy. Subsidies will flow not to fuel producers (as is the case so far), but to CO2 emitters, which account for 97% of our economy. So, to win with such powerful lobbyists as Gazprom or Exxon Mobil, we will need even more money for lobbying. It should be remembered that currently, the regulations do not take into account the fact that CO2 emitters are dependent on fossil fuels and do not have the necessary incentive and financial means to reduce them. The situation will change after the introduction of CAT, because from now on, CO2 emitters will have a real interest in investing in zero-emission energy sources. In this way, we can create a strong lobby to save the climate.

They constitute at most 3% of the world economy. So those who benefit the most from poisoning our planet will have to pay the costs of decarbonizing the economy. Subsidies will flow not to fuel producers (as is the case so far), but to CO2 emitters, which account for 97% of our economy. So, to win with such powerful lobbyists as Gazprom or Exxon Mobil, we will need even more money for lobbying. It should be remembered that currently, the regulations do not take into account the fact that CO2 emitters are dependent on fossil fuels and do not have the necessary incentive and financial means to reduce them. The situation will change after the introduction of CAT, because from now on, CO2 emitters will have a real interest in investing in zero-emission energy sources. In this way, we can create a strong lobby to save the climate.

- Details

- Written by: admin

- Category: Idea CAD EN

- Hits: 62

Generally, people dislike taxes, except when the taxpayer is someone else and the beneficiaries are themselves. For this reason, politicians attempt to impose taxes in a manner that makes their payer a relatively small group of people and their beneficiaries as large as possible. It is no different from CO2 emission limits, which are also a form of tax. They were imposed on almost all CO2 emitters, but they were not imposed on car owners. The question may be asked why airlines have to pay for emissions and car owners do not? The answer is clear, simple, and obvious. Too many voters are simply owners of cars, and it would be political suicide to impose any restrictions on this group of voters. This inconsistency is contrary to the objective of reducing emissions but completely rational in political terms. Now, let's analyze the CAT tax politically. The direct taxpayers will be the owners of coal mines, shareholders of oil companies, and importers of fossil fuels; it is a very small group of people. For example, in Poland, we have 170,000 miners, which represents about 0.5% of voters. But 100% of voters can be the beneficiaries of subsidies flowing from CAT because even miners and owners of Exxon Mobil emit CO2 in some way. All of them, from owners of coal power plants to owners of gas stoves, can benefit materially from the subsidies flowing from CAT. This should increase the popularity of climate-saving measures for both voters and politicians.

The question may be asked why airlines have to pay for emissions and car owners do not? The answer is clear, simple, and obvious. Too many voters are simply owners of cars, and it would be political suicide to impose any restrictions on this group of voters. This inconsistency is contrary to the objective of reducing emissions but completely rational in political terms. Now, let's analyze the CAT tax politically. The direct taxpayers will be the owners of coal mines, shareholders of oil companies, and importers of fossil fuels; it is a very small group of people. For example, in Poland, we have 170,000 miners, which represents about 0.5% of voters. But 100% of voters can be the beneficiaries of subsidies flowing from CAT because even miners and owners of Exxon Mobil emit CO2 in some way. All of them, from owners of coal power plants to owners of gas stoves, can benefit materially from the subsidies flowing from CAT. This should increase the popularity of climate-saving measures for both voters and politicians.